The Concentrated Stock Puzzle

By OSAM Research TeamSeptember 2021

Managing concentrated positions is a common challenge for financial advisors. Many of their clients are entrepreneurs, employees of start-ups, or corporate executives that have significant wealth tied up in low-cost basis stock or options. While most agree on the value of diversification, transitioning from one or a few concentrated positions to a diversified portfolio is still a challenging puzzle – consisting of biases and significant tax consequences.

The Puzzle

Company stock ownership can be one of the greatest drivers of wealth creation. While individuals continue to see their wealth increase, the excess risk relative to the market is often overlooked. Why? Individuals typically show extreme loyalty to their company, thinking it is bulletproof. While that may be, three key data points suggest that caution is warranted.

1) The average individual stock underperforms the market.

- 64% underperform the Russell 1000® Index.1

2) Single stock volatility is 2x greater than the market, heavily influenced by key ‘event risks.’

3) The ‘great’ companies of today aren’t the ‘great’ companies of tomorrow.

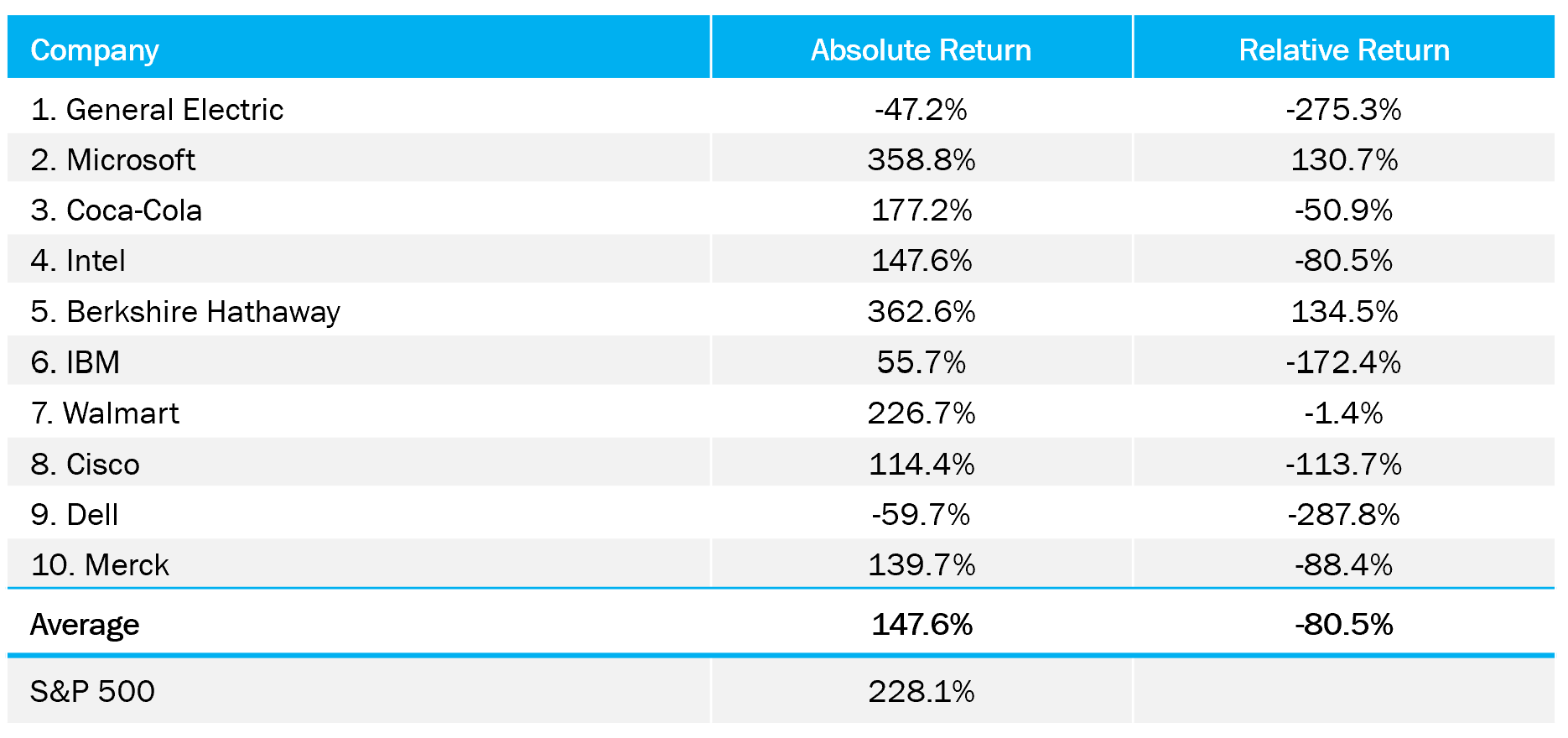

The table below shows Fortune’s ‘Most Admired’ Companies of 1999 alongside their subsequent 20-year returns. The average performance of this group underperformed the S&P 500 Index by 80.5%.

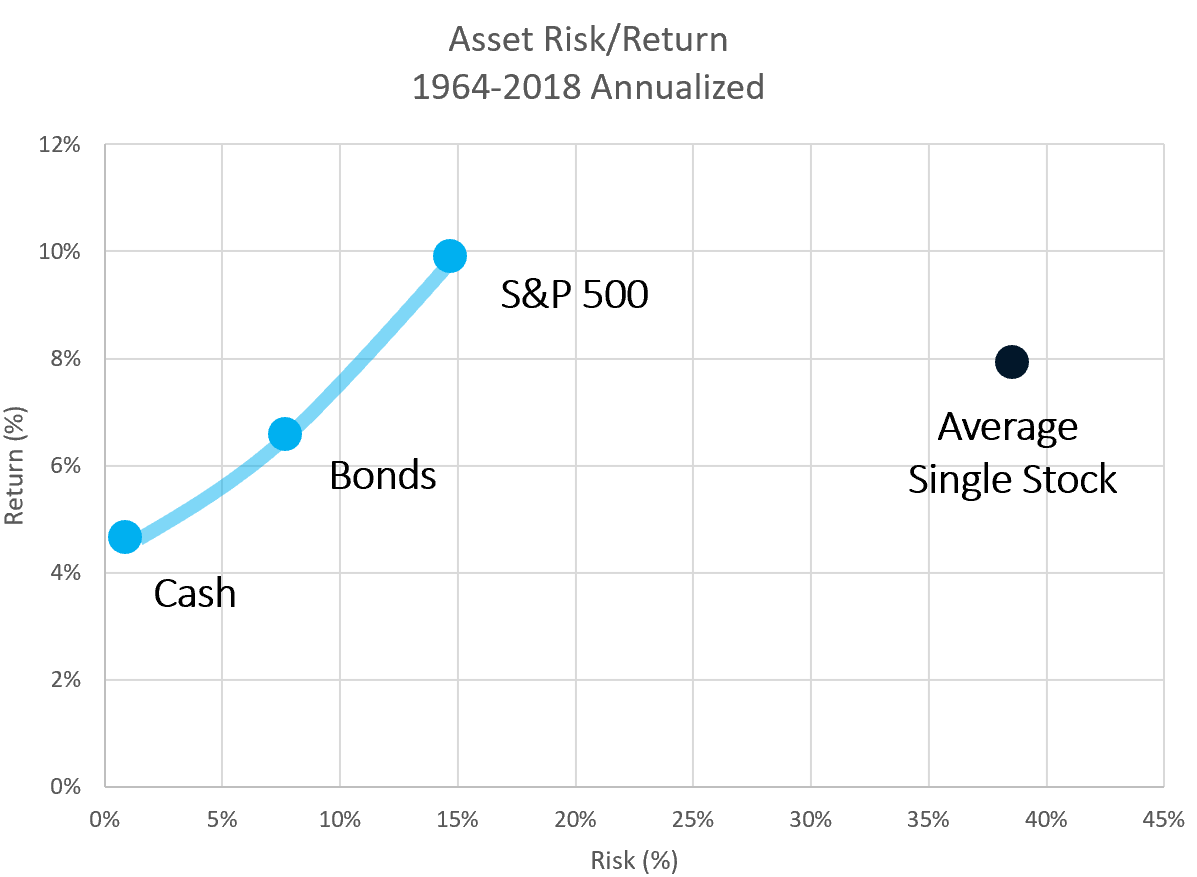

In short, the average risk/return profile of a concentrated position relative to a diversified portfolio (S&P 500) requires taking significantly more risk for meaningfully lower expected return.

Figure 1: Return/Risk Profile for a Single Stock

This leads to a difficult paradox for investors, the source of their wealth creation can be the largest impediment to their wealth preservation.

Transitioning towards a diversified portfolio has its challenges. Many clients we work with hold large positions at a nearly $0 cost basis. Thus, selling down these securities often triggers a massive tax hit. As quantitative asset managers focused on custom solutions, we ventured to build a tool within Canvas that can navigate the delicate balance between risk, tax impact, and company sentiment – helping clients get to an optimal portfolio quicker and more tax efficiently. Using Canvas, advisors can now diversify these concentrated positions in a way that is personalized to them.

A Case Study on Managing Concentrated Risk: Accenture (ACN)

Transitioning a concentrated position comes down to two key aspects:

1) Tailoring a portfolio around the concentrated exposure

2) Continually tax loss harvesting to realize losses that can be used to offset the embedded gains

We will share a real-life example to illustrate the systematic Canvas process:

An advisor approached us about a client with a 65% portfolio weight to Accenture. The investor’s cost basis was effectively $0, meaning a full liquidation would generate a significant tax bill. The advisor wanted to transition their client into a diversified portfolio while minimizing the tax hit. While this entire process can be driven via advisor facing software, we bring the platform analysis to you through words and images below.

Step 1: Applying A Risk Framework to Diversify

Canvas utilizes proprietary risk modeling to assess the drivers of risk for stocks. These 'drivers' include common themes like industry, geography, macroeconomic drivers (interest rates, inflation, oil, etc.), as well as factors like value, momentum, yield, and quality. The optimizer uses this risk assessment to understand a stock’s underlying exposures.

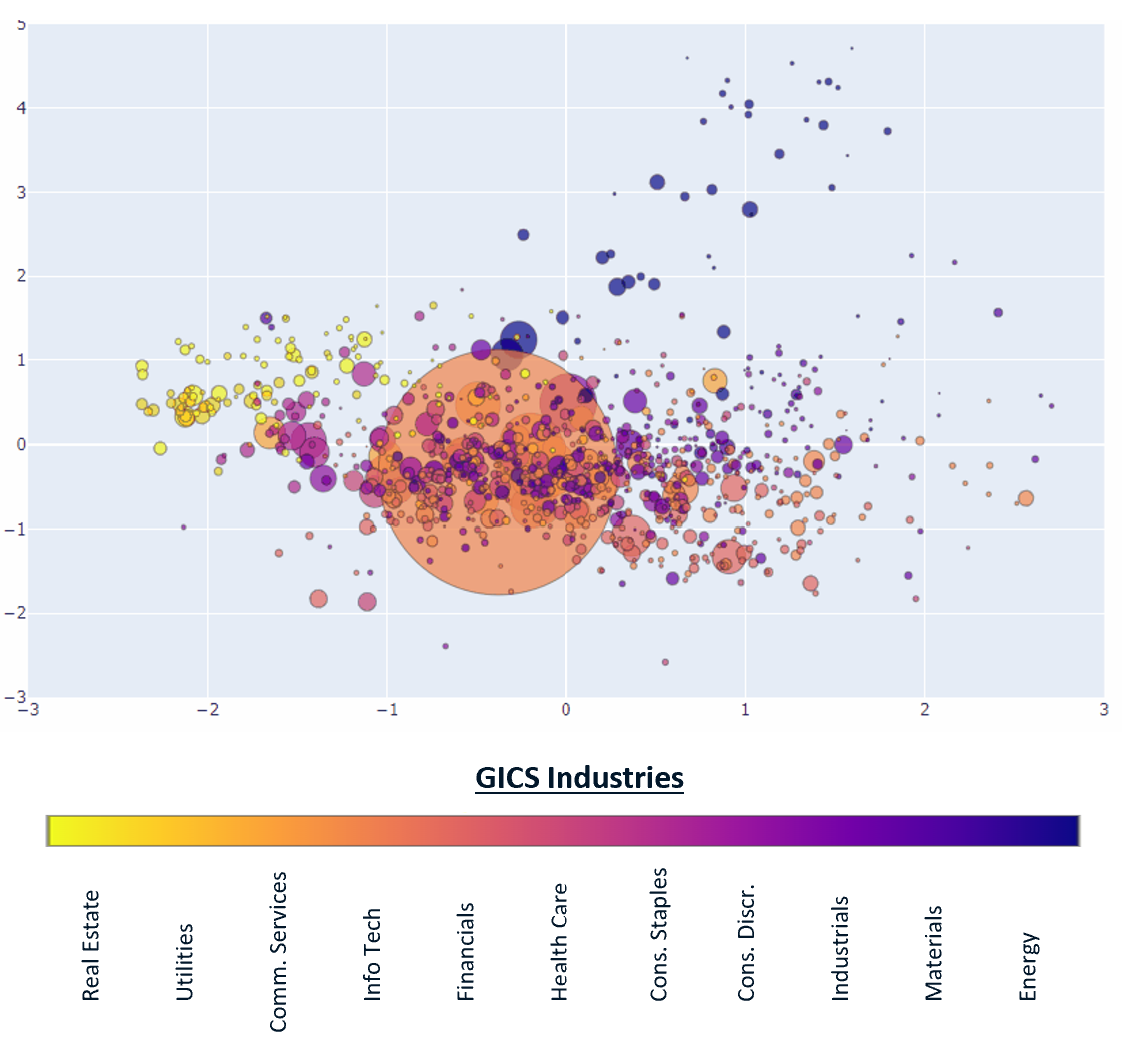

The chart below distills 51 risk factors into a 2D visual of how Accenture’s risk profile compares to the broader market. The size of the circles correspond to each stock’s risk contribution to the Russell 1000 Index and the colors correspond to sectors. Proximity of circles signifies similar risk profiles, so overlapping circles represent overlapping risk exposures.

Figure 2: Representative Risk Exposure Within Russell 1000 Index2

By adjusting the image above for the portfolio’s 65% weight to Accenture, the Accenture risk bubble gets significantly larger. A typical solution to diversification is ‘bolting-on’ market exposure to the outsized position via an index fund. However, this construction is agnostic to the outsized position’s risk profile and often creates overlapping risk.

Figure 3: Overlapping Exposure from Typical ‘Bolt-On’

It is clear in Figure 3 that the traditional ‘bolt-on’ tactic contributes to additional or overlapping risk. To rectify this, Canvas identifies a stock’s ‘nearest neighbors.’

Figure 4: Identifying Nearest Neighbors

After identifying the nearest neighbors (a few highlighted above), companies with similar risk profiles are restricted or underweighted and a representative-index can be established around the concentrated position delivering an investment experience closer to the market while mitigating concentration risk.

Figure 5: Building Around the Position Via a Representative Index

Canvas portfolios are managed as Custom Indexes, which offer the power of a Direct Index – investing directly in the underlying holdings of an index – but customized to you. In this case, rebuilding the passive or index investing experience while accounting for a significant overweight to Accenture.

Step 2: Combining Diversification with Tax Management

Building around the concentrated position certainly helps, but the largest determinant of risk is the size of the concentrated position itself. Reducing the position size makes the client’s risk level more in line with the overall market, but the trade-off for this is the tax impact from capital gains when selling down the position.

Tax loss harvesting is the engine that helps reduce concentrated risk and limit capital gains. Historically, 36% of positions in the Russell 1000 Index deliver a negative return annually. By building a representative index consisting of an extensive basket of individual stocks, there is ample opportunity to capture losses over time that can be used to offset capital gains incurred from selling down the concentrated position.

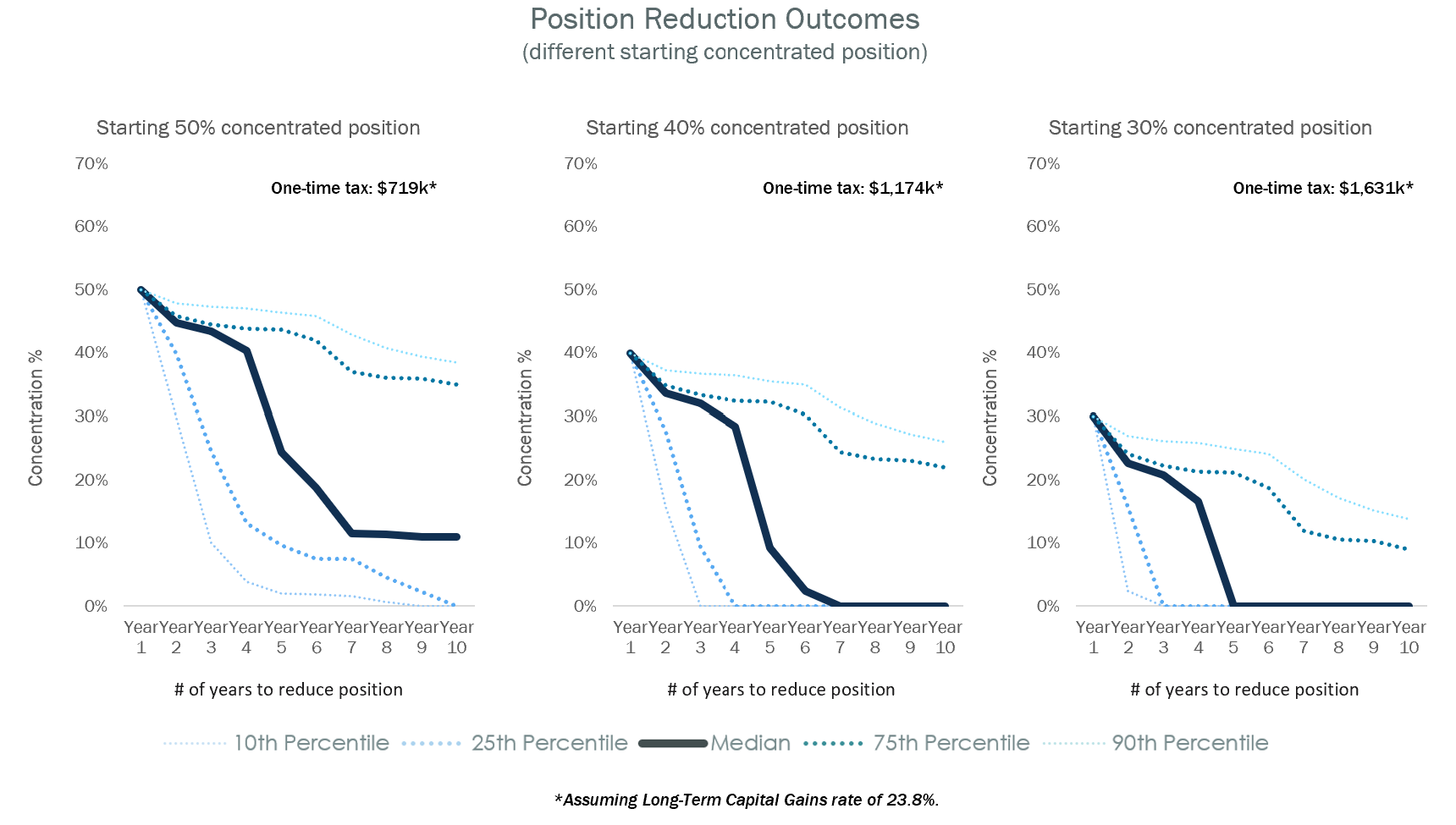

The transition itself is influenced by three key questions:

1) What amount of taxes are acceptable from an initial liquidation?

2) What amount of taxes are acceptable on an annual basis?

3) How long are you willing to tolerate the concentrated stock risk?

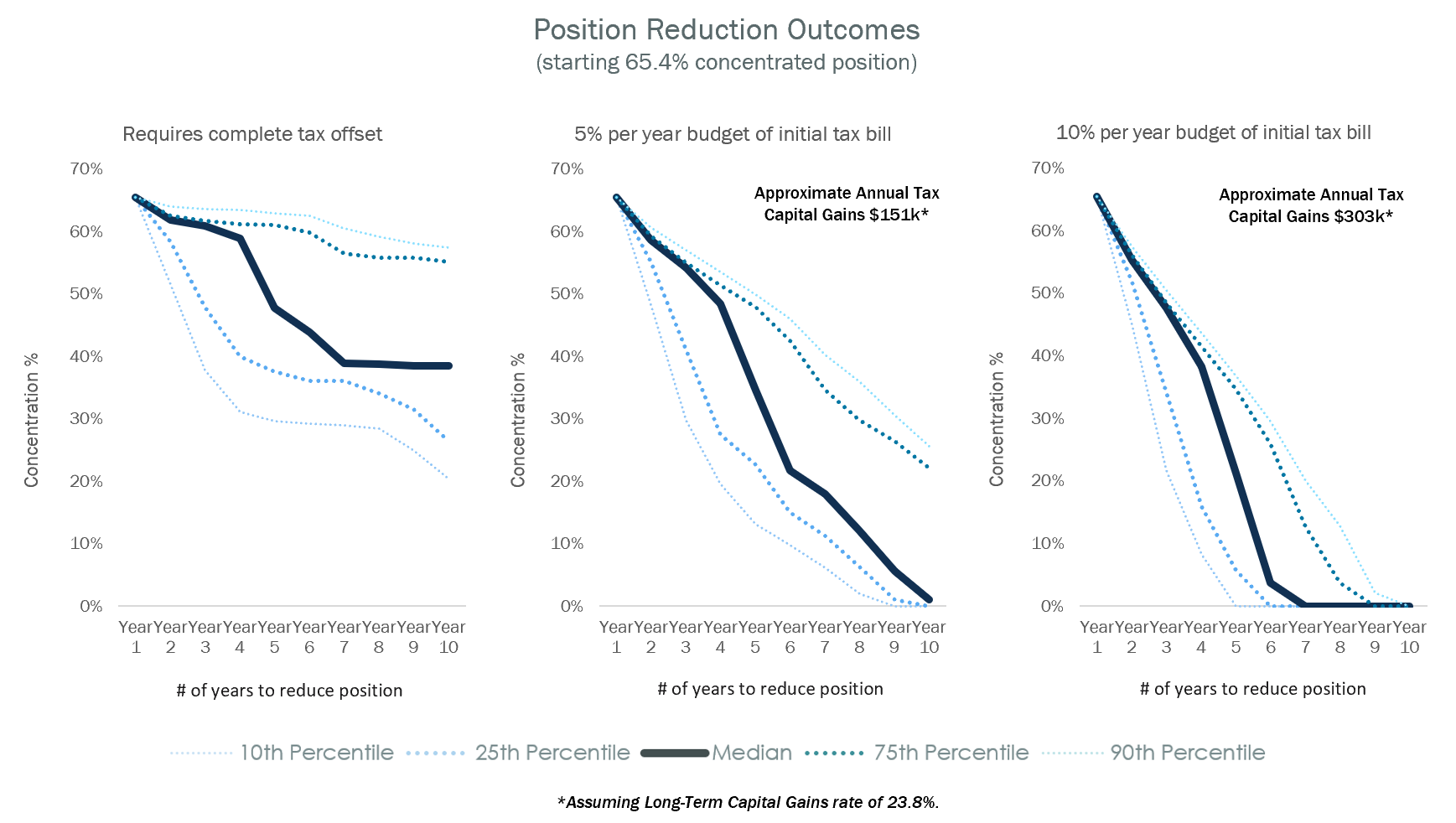

Within the Canvas platform, advisors can input holdings and parameters to understand potential outcomes (see below). We refer to these outcomes as ‘glidepaths’.

Figure 6: Varying Outcomes Based on Annual Tax Budget

Figure 6 shows three different outcomes based on three different annual tax budgets. As expected, the more taxes you are willing to accept, the faster the position can be transitioned. A similar story occurs with respect to any initial liquidation, Figure 7.

Figure 7: Varying Outcomes Based on Initial Liquidation

We often recommend using both an initial liquidation and an annual tax budget to reduce the position to market weight within five years.

The Actual Results

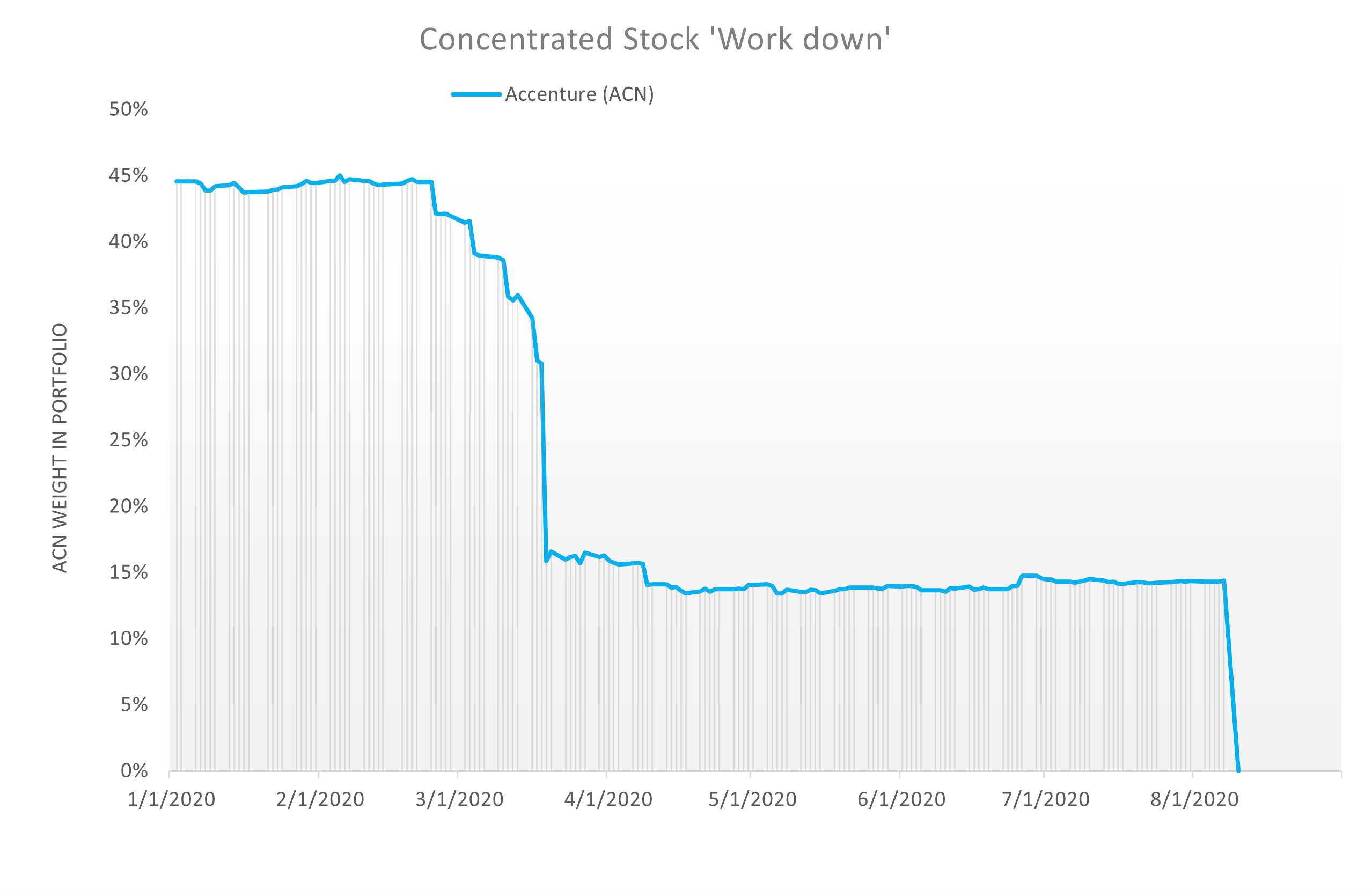

Tax budgets aside, the primary driver of managing concentrated risk is the underlying market. Exceptionally strong or weak markets can significantly impact the ability to harvest losses and subsequently reduce concentrated positions. After working through the analysis, the client opened the account in December of 2019 with a 45% weight to Accenture and a goal to reduce the position to market weight without generating capital gains. Though we’d typically expect this to take multiple years, they were the beneficiary of the 1Q 2020 downturn. In the first quarter alone, we were able to reduce the weight of Accenture to just over 15% with zero capital gains realized. When many investment managers missed the full opportunity, we were continually harvesting, catching each opportunity to harvest losses and expedite the transition. All in all, we managed this position for eight months, reducing its weight below 14% without incurring a tax hit. The success of this transition led the advisor to liquidate the entire position in August, assuming their fully diversified target model at a fraction of the tax cost and time.

Figure 8: Actual Reduction of Accenture Exposure

Though downturns are tough on everyone, in this instance it was a very helpful tax asset. Rather than being in year two of a multi-year transition, today the client is fully deployed into a diversified portfolio. Note, when leveraging software like Canvas, it doesn’t take a historic downturn to provide material value. Everyday there are stocks trading at a loss. As long as you have exposure to a large portfolio of stocks and are running a dynamic and automated process constantly looking for losses, there is a foundation for reducing concentrated risk in a timely and tax-efficient manner.

Private Company Risk Mapping

The Accenture case is a clean example of working with a public company that has 20 years of risk and return data. However, many entrepreneurs and owners receive private stock and options. We recently worked on two private company cases as the companies approached their IPO. With an impending liquidity event, the advisors sought to develop a road map that captured the momentous event financially and reduced the associated risk tax-efficiently.

The risk management process for private companies is very similar to public companies, however, frameworks and optimizers that straddle public and private markets are hard to come by. To solve this, we developed a process that pairs multiple non-market data points with machine learning algorithms to build a public market proxy that can be used to build around the private – or recently IPO’d – concentrated position. Managing private market risk in concert with public market risk is essential for overall portfolio management. We seek to continue developing tools that enhance customization, risk-return profile, and tax management across asset classes.

Canvas

At its core, Canvas is a platform that enables advisors to tailor portfolios for very specific client needs. We may never see a 45% concentration in Accenture again, but similar situations are coming across advisor desks more and more. We have come to appreciate the pervasiveness of this investing problem and leveraged quantitative analysis to solve for it. Whether it is a single or basket of concentrated stocks, we believe in diversification, and empowering investors with the tools needed to solve this risk, sentiment, and cost puzzle.

FOOTNOTES

1 Based on a study of 2,673 U.S. large cap companies from 1964-2018 from the period they entered the large cap universe until a terminal event (bankruptcy, delisting, merger, acquisition, or the present).

2 The X and Y axis represent statistical risk factors calculated via Principal Component Analysis.

GENERAL LEGAL DISCLOSURES & HYPOTHETICAL AND/OR BACKTESTED RESULTS DISCLAIMER

The material contained herein is intended as a general market commentary. Opinions expressed herein are solely those of O’Shaughnessy Asset Management, LLC and may differ from those of your broker or investment firm.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by O’Shaughnessy Asset Management, LLC), or any non-investment related content, made reference to directly or indirectly in this piece will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this piece serves as the receipt of, or as a substitute for, personalized investment advice from O’Shaughnessy Asset Management, LLC. Any individual account performance information reflects the reinvestment of dividends (to the extent applicable), and is net of applicable transaction fees, O’Shaughnessy Asset Management, LLC’s investment management fee (if debited directly from the account), and any other related account expenses. Account information has been compiled solely by O’Shaughnessy Asset Management, LLC, has not been independently verified, and does not reflect the impact of taxes on non-qualified accounts. In preparing this report, O’Shaughnessy Asset Management, LLC has relied upon information provided by the account custodian. Please defer to formal tax documents received from the account custodian for cost basis and tax reporting purposes. Please remember to contact O’Shaughnessy Asset Management, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or modify any reasonable restrictions to our investment advisory services. Please Note: Unless you advise, in writing, to the contrary, we will assume that there are no restrictions on our services, other than to manage the account in accordance with your designated investment objective. Please Also Note: Please compare this statement with account statements received from the account custodian. The account custodian does not verify the accuracy of the advisory fee calculation. Please advise us if you have not been receiving monthly statements from the account custodian. Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. O’Shaughnessy Asset Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the O’Shaughnessy Asset Management, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request.

The risk-free rate used in the calculation of Sortino, Sharpe, and Treynor ratios is 5%, consistently applied across time.

The universe of All Stocks consists of all securities in the Chicago Research in Security Prices (CRSP) dataset or S&P Compustat Database (or other, as noted) with inflation-adjusted market capitalization greater than $200 million as of most recent year-end. The universe of Large Stocks consists of all securities in the Chicago Research in Security Prices (CRSP) dataset or S&P Compustat Database (or other, as noted) with inflation-adjusted market capitalization greater than the universe average as of most recent year-end. The stocks are equally weighted and generally rebalanced annually.

Hypothetical performance results shown on the preceding pages are backtested and do not represent the performance of any account managed by OSAM, but were achieved by means of the retroactive application of each of the previously referenced models, certain aspects of which may have been designed with the benefit of hindsight.

The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual accounts had been managed throughout the period, ongoing research might have resulted in changes to the strategy which might have altered returns. The performance of any account or investment strategy managed by OSAM will differ from the hypothetical backtested performance results for each factor shown herein for a number of reasons, including without limitation the following:

- Although OSAM may consider from time to time one or more of the factors noted herein in managing any account, it may not consider all or any of such factors. OSAM may (and will) from time to time consider factors in addition to those noted herein in managing any account.

- OSAM may rebalance an account more frequently or less frequently than annually and at times other than presented herein.

- OSAM may from time to time manage an account by using non-quantitative, subjective investment management methodologies in conjunction with the application of factors.

- The hypothetical backtested performance results assume full investment, whereas an account managed by OSAM may have a positive cash position upon rebalance. Had the hypothetical backtested performance results included a positive cash position, the results would have been different and generally would have been lower.

- The hypothetical backtested performance results for each factor do not reflect any transaction costs of buying and selling securities, investment management fees (including without limitation management fees and performance fees), custody and other costs, or taxes – all of which would be incurred by an investor in any account managed by OSAM. If such costs and fees were reflected, the hypothetical backtested performance results would be lower.

- The hypothetical performance does not reflect the reinvestment of dividends and distributions therefrom, interest, capital gains and withholding taxes.

- Accounts managed by OSAM are subject to additions and redemptions of assets under management, which may positively or negatively affect performance depending generally upon the timing of such events in relation to the market’s direction.

- Simulated returns may be dependent on the market and economic conditions that existed during the period. Future market or economic conditions can adversely affect the returns.

Please Note: Socially Responsible Investing Limitations. Socially Responsible Investing involves the incorporation of Environmental, Social and Governance considerations into the investment due diligence process (“ESG). There are potential limitations associated with allocating a portion of an investment portfolio in ESG securities (i.e., securities that have a mandate to avoid, when possible, investments in such products as alcohol, tobacco, firearms, oil drilling, gambling, etc.). The number of these securities may be limited when compared to those that do not maintain such a mandate. ESG securities could underperform broad market indices. Investors must accept these limitations, including potential for underperformance. Correspondingly, the number of ESG mutual funds and exchange traded funds are few when compared to those that do not maintain such a mandate. As with any type of investment (including any investment and/or investment strategies recommended and/or undertaken by OSAM), there can be no assurance that investment in ESG securities or funds will be profitable, or prove successful.