Shareholder Yield: A Differentiated Approach to an ‘Efficient’ Market – US Large Cap Value

By OSAM Research TeamSeptember 2019

Following the 2008 financial crisis, passive investing has gained popularity as indices designed to capture market beta have benefited from a record-breaking bull market. By design, the underlying securities in an index are weighted by market capitalization. Consequently, traditional passive investing is an implicit bet on market capitalization as an investment factor, which we believe is flawed.

Market Capitalization is a Poor Investment Factor

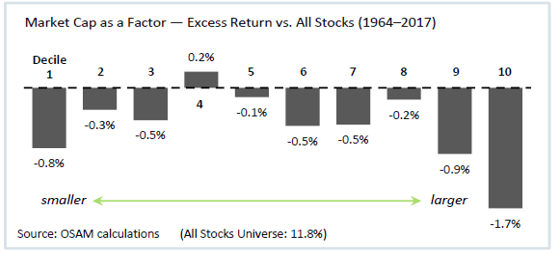

In the chart below, we use S&P Compustat data to create example portfolios grouped by market cap. The selection universe in this paper, ‘All Stocks’, is equally‐weighted, and serves as the benchmark for all factor excess returns.* For comparative purposes, the All Stocks universe is analogous to an equally-weighted Russell 3000® Index.

The chart clearly shows that larger stocks have historically underperformed over the long term, which is problematic, since most passive equity investments are concentrated in the two lowest performing deciles (9 and 10). Additionally, in rolling five-year observations, these groups of stocks tend to underperform our All Stocks Universe more than half of the time. There is clearly room for improvement in the ‘efficient’ large cap universe.

Shareholder Yield: Alpha Generation in Large Cap Stocks

In our view, management teams serve their shareholders in two capacities: (1) generate profits and (2) allocate those profits as efficiently as possible for shareholders’ long‐term benefit. In an analysis of corporate allocation over several decades, we find that the most rewarding way to allocate capital is to return it to shareholders. And while dividend income has its virtues, it’s taxed twice—once at the corporate level and again at the individual level. A great advantage of buybacks is that continuing shareholders don’t pay the second round of taxes.

At OSAM, our approach aims to capture the benefits of both dividends and buybacks. Shareholder Yield is the sum of a stock’s dividend yield (paid over previous twelve months minus special dividends) and the percentage of net share buybacks over the previous twelve months. It is a powerful tool for identifying good management teams.

In fact, one of the most effective stock selection strategies in the U.S. over recent decades has been buying stocks in the midst of repurchasing significant quantities of their shares. Before diving into our analysis, though, we must understand why companies would repurchase their own shares:

- Companies like to repurchase shares when their stock is cheap, and a big buyback program often sends a message to investors that a company’s management believes its stock is trading below intrinsic value.

- Shares are sometimes bought back to offset the dilution that happens when shares are granted to employees.

- Share repurchases can be used to “manage” or “boost” earnings per share (EPS).

Investors using buybacks as a factor to select stocks should ensure that companies are buying back stock for the first reason, and not for the second two.

Identifying the Best Buyback Programs

What has caused the recent boom in buyback programs, though? Regulation changes have contributed to this, as Safe Harbor legislation through SEC Rule 10b-18 in 1982 loosened the restrictions for when a company can repurchase stock. Do not underestimate the effect changes in regulation can have.

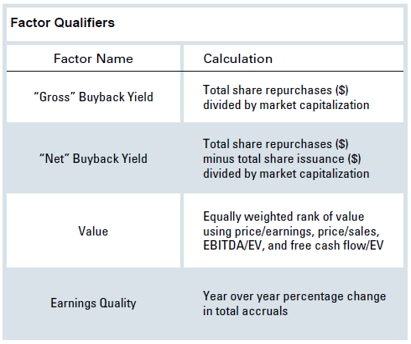

With this loosened regulation came opportunity. Repurchasing undervalued shares is one of the best ways to create value for shareholders, though not all share repurchases are created equal. Three qualifiers help identify the most attractive repurchasers:

- Focus on “net” buyback yield, which takes share issuance into account alongside buybacks, rather than “gross” yield, which does not.

- Avoid companies that have significant buyback programs but trade at expensive valuation multiples.

- Avoid the “EPS management” problem by insisting on strong quality of earnings alongside big buyback programs.

Shareholder Yield: Net Buybacks

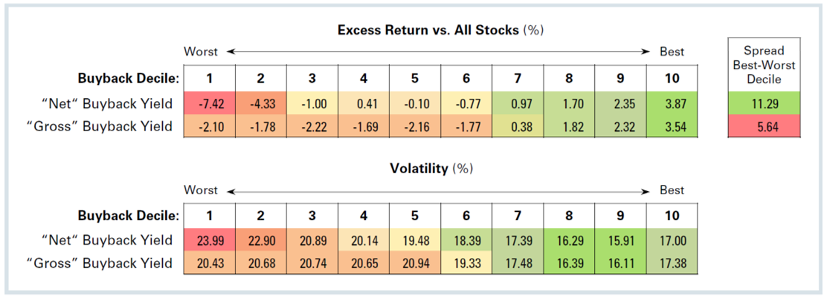

First, we compare the two different calculations for “buyback yield."1 The table below breaks the universe of all U.S. stocks into deciles based on the two measures of buybacks, and shows the excess return of each decile since 1987.2 In each case, companies that have made the largest share repurchases over the prior year have gone on to significantly outperform the market in the following year and have done so with low volatility, while companies issuing large amounts of equity underperformed by a wide margin.

Using net buybacks instead of gross protects investors against firms that are repurchasing shares just to offset shares issued to employees, or other non-value creating reasons.

Shareholder Yield: Value

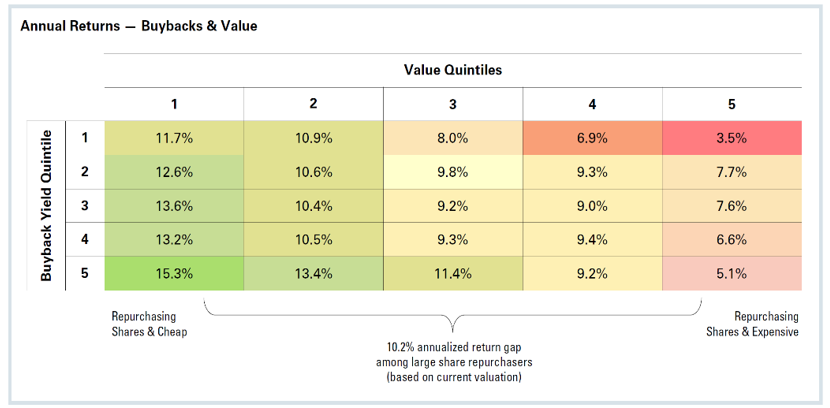

The large cap space is supposedly the most “efficient” and difficult to outperform, but most large buyback programs are conducted by large, established firms. By narrowing our analysis to just large stocks, however, we demonstrate that two additional refinements significantly improve the raw buyback signal.

After controlling for the first pitfall of buybacks (repurchases to offset share issuance), the second pitfall is buying companies with large buyback programs that repurchase shares at exactly the wrong time: when their stock price is very expensive. The table to the right breaks all large stocks into 25 groups according to two factors: their net buyback yield, and their valuations.

Stocks in the upper right are both expensive and issuing shares; a brutal combination. Stocks in the lower left, with a return of 15.3 percent, are buying back lots of shares, but when the stock is also cheap; a historically powerful combination. Finally, stocks in the lower right are also buying back lots of shares but at expensive valuation multiples. This final group has a return of just 5.1 percent, confirming that Value is a crucial component to any strategy favoring large buybacks.

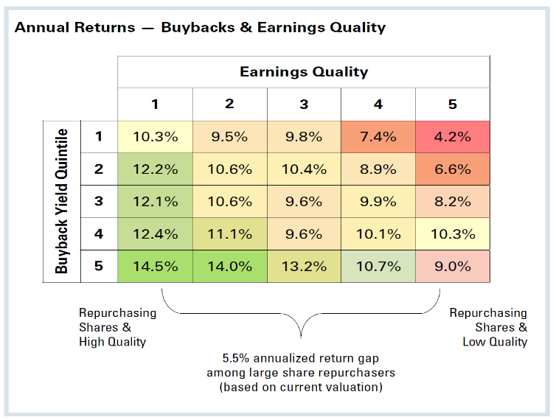

Shareholder Yield: Earnings Quality

The final qualification is avoiding companies that seem to be manipulating or smoothing their earnings. The below table shows the same 25 groups among large cap stocks, but instead of combining buybacks with value, it combines buybacks with earnings quality. A similar story emerges. The bottom row illustrates that strong buybacks and strong earnings quality produce a much better annual result (14.5 percent) than strong buybacks and poor earnings quality (9.0 percent).

Scope of the High Conviction Market

Only some thirty percent of all buybacks come from ‘high conviction’ firms repurchasing between five and ten percent of their shares. The ‘very high conviction’ firms, repurchasing more than ten percent is a smaller segment.

The Results: A Complete Approach to Yield

Buyback programs are a strong proxy for management discipline. If managers recognize value in their own share price, then foregoing misguided investments and opting instead for large share repurchases can create huge value for shareholders.

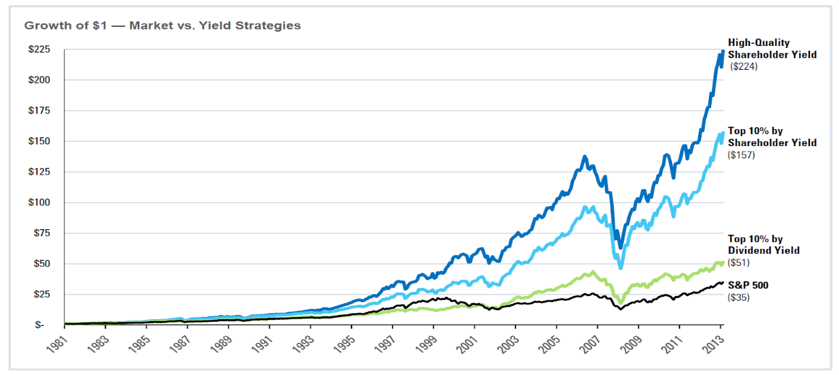

Bringing these concepts together, consider the growth of $1 invested in 1982 in four different large cap strategies:

- S&P 500

- Top 10 percent of large stocks by Dividend Yield*

- Top 10 percent of large stocks by Shareholder Yield(dividends + buybacks)*

- Top Large Stocks by Shareholder Yield after eliminating the half of the stock universe with the lowest valuation and poorest quality*

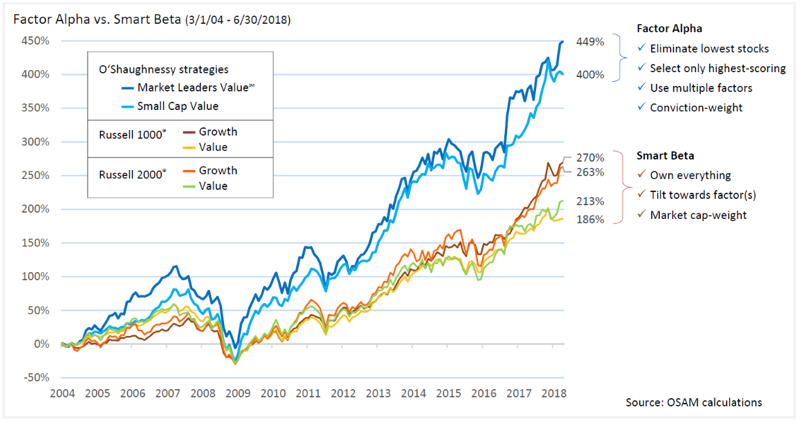

Conclusion: Shareholder Yield Generates Alpha in Large Cap Stocks

When utilizing buybacks as an investment signal, apply the President Reagan maxim of “Trust, but verify.” Buybacks should be used in combination with value to confirm management’s motives for repurchasing shares and to ensure that they are buying at a discount. Use accruals to make sure that management isn’t manipulating earnings, and “net” buyback yield to adjust for share issuance. Used collectively, this approach can provide a comprehensive look into a company and allow investors to use stock buybacks as a signal for wise investments.

The strong outperformance of OSAM’s Market Leaders Value strategy is a testament to the power of Shareholder Yield in the ‘efficient’ large cap space.

Footnotes

1 The period tested is 1987–2014 because the statement of cash flows is required to calculate gross and net buyback yield.

2 Rebalanced on a rolling annual basis.

GENERAL LEGAL DISCLOSURES & HYPOTHETICAL AND/OR BACKTESTED RESULTS DISCLAIMER

The material contained herein is intended as a general market commentary. Opinions expressed herein are solely those of O’Shaughnessy Asset Management, LLC and may differ from those of your broker or investment firm.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by O’Shaughnessy Asset Management, LLC), or any non-investment related content, made reference to directly or indirectly in this piece will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this piece serves as the receipt of, or as a substitute for, personalized investment advice from O’Shaughnessy Asset Management, LLC. Any individual account performance information reflects the reinvestment of dividends (to the extent applicable), and is net of applicable transaction fees, O’Shaughnessy Asset Management, LLC’s investment management fee (if debited directly from the account), and any other related account expenses. Account information has been compiled solely by O’Shaughnessy Asset Management, LLC, has not been independently verified, and does not reflect the impact of taxes on non-qualified accounts. In preparing this report, O’Shaughnessy Asset Management, LLC has relied upon information provided by the account custodian. Please defer to formal tax documents received from the account custodian for cost basis and tax reporting purposes. Please remember to contact O’Shaughnessy Asset Management, LLC, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or modify any reasonable restrictions to our investment advisory services. Please Note: Unless you advise, in writing, to the contrary, we will assume that there are no restrictions on our services, other than to manage the account in accordance with your designated investment objective. Please Also Note: Please compare this statement with account statements received from the account custodian. The account custodian does not verify the accuracy of the advisory fee calculation. Please advise us if you have not been receiving monthly statements from the account custodian. Historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. O’Shaughnessy Asset Management, LLC is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the O’Shaughnessy Asset Management, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request.

Hypothetical performance results shown on the preceding pages are backtested and do not represent the performance of any account managed by OSAM, but were achieved by means of the retroactive application of each of the previously referenced models, certain aspects of which may have been designed with the benefit of hindsight.

The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual accounts had been managed throughout the period, ongoing research might have resulted in changes to the strategy which might have altered returns. The performance of any account or investment strategy managed by OSAM will differ from the hypothetical backtested performance results for each factor shown herein for a number of reasons, including without limitation the following:

· Although OSAM may consider from time to time one or more of the factors noted herein in managing any account, it may not consider all or any of such factors. OSAM may (and will) from time to time consider factors in addition to those noted herein in managing any account.

· OSAM may rebalance an account more frequently or less frequently than annually and at times other than presented herein.

· OSAM may from time to time manage an account by using non-quantitative, subjective investment management methodologies in conjunction with the application of factors.

· The hypothetical backtested performance results assume full investment, whereas an account managed by OSAM may have a positive cash position upon rebalance. Had the hypothetical backtested performance results included a positive cash position, the results would have been different and generally would have been lower.

· The hypothetical backtested performance results for each factor do not reflect any transaction costs of buying and selling securities, investment management fees (including without limitation management fees and performance fees), custody and other costs, or taxes – all of which would be incurred by an investor in any account managed by OSAM. If such costs and fees were reflected, the hypothetical backtested performance results would be lower.

· The hypothetical performance does not reflect the reinvestment of dividends and distributions therefrom, interest, capital gains and withholding taxes.

· Accounts managed by OSAM are subject to additions and redemptions of assets under management, which may positively or negatively affect performance depending generally upon the timing of such events in relation to the market’s direction.

· Simulated returns may be dependent on the market and economic conditions that existed during the period. Future market or economic conditions can adversely affect the returns.